Exploring the Depths of Wealth: The Psychology of Money Audiobook Review

Unlocking the Secrets of Wealth: A Deep Dive into “The Psychology of Money”

In The Psychology of Money audiobook, Morgan Housel delivers more than just financial advice; he explores how our attitudes, beliefs, and behaviors shape our financial decisions.

This review delves into the core lessons from Housel’s book, offering a roadmap to understanding the complex relationship between psychology and money.

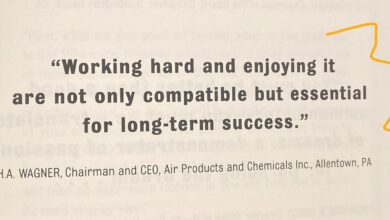

- Wealth and Happiness: Housel starts with a simple yet profound equation: happiness is results minus expectations. This perspective sets the tone for understanding the subjective nature of financial satisfaction.

- Compounding’s Power: One of the book’s most striking revelations is how Warren Buffett’s $84.5 billion net worth is primarily the result of compounding after his 65th birthday, showcasing the incredible power of patience in wealth accumulation.

- Time over Money: A critical insight from Housel is that money’s most significant value is its ability to give you control over your time, elevating the importance of financial independence over mere wealth accumulation.

- The Invisible Nature of Wealth: According to Housel, true wealth isn’t about what you spend but what you save and invest – the unseen aspect of financial success.

- Savings Rate is Crucial: Contrary to common belief, Housel argues that building wealth has less to do with income or investment returns and more with your savings rate.

- Savings as Life’s Shock Absorber: Saving money is portrayed as a hedge against life’s unpredictability, providing a buffer against unforeseen financial shocks.

- Risk and Russian Roulette: Housel uses Russian roulette as a metaphor to discuss risk, highlighting the importance of understanding the potential downsides in financial decisions.

- Contextual Financial Decisions: One of the book’s practical advice is to beware of taking financial cues from others, as each individual’s financial journey is unique.

- Optimism vs. Pessimism: The book also touches on the perception of optimism and pessimism in financial advice, stressing the importance of balanced and informed optimism.

- Illusion of Control vs. Uncertainty: Lastly, Housel discusses how the illusion of control often trumps the reality of uncertainty in financial matters, urging readers to embrace and plan for unpredictability.

A Transformative Book

The Psychology of Money isn’t just informative; it’s transformative. Housel’s skillful blend of storytelling with financial insights makes complex concepts accessible and engaging.

The book is compelling for anyone interested in personal finance, investing, or understanding the forces at play in financial decision-making.

It challenges traditional notions about money, urging readers to look beyond numbers and consider psychological factors.

The Psychology of Money Audiobook

In conclusion, The Psychology of Money audiobook is more than a financial guide; it’s a journey into the heart of what money means to us as individuals.

It’s available in various formats, including an engaging audiobook, making it accessible to a broad audience.

Whether you’re a seasoned investor or just starting your financial journey, this book is an invaluable resource that promises to change how you think about money.

Timothy Borchers is an accomplished executive with extensive international business experience, specializing in the transportation and travel sectors. His profound understanding of these industries complements his expertise in personal development and relationship dynamics. Featured on various platforms, Timothy’s thoughtful analyses and curated book selections offer readers invaluable guidance for navigating their personal and professional journeys, transportation logistics, and holiday travel experiences.